Discover the power of AI

for optimised commercial credit decisionsThe RDC Platform augments expert human knowledge with AI capabilities, providing financial institutions a competitive edge in lending

AI Decisioning as a Service

Achieve superior lending outcomes

Our unique ‘glass box’ approach enables lenders to use AI with confidence.

Embedded with AI ethical principles to ensure compliance, our tooling allows lenders to visualise and understand the logic behind every AI predictive model and decision strategy.

Leverage traditional, alternative, and latent data with leading AI techniques to make accurate predictions and achieve optimal decision outcomes.

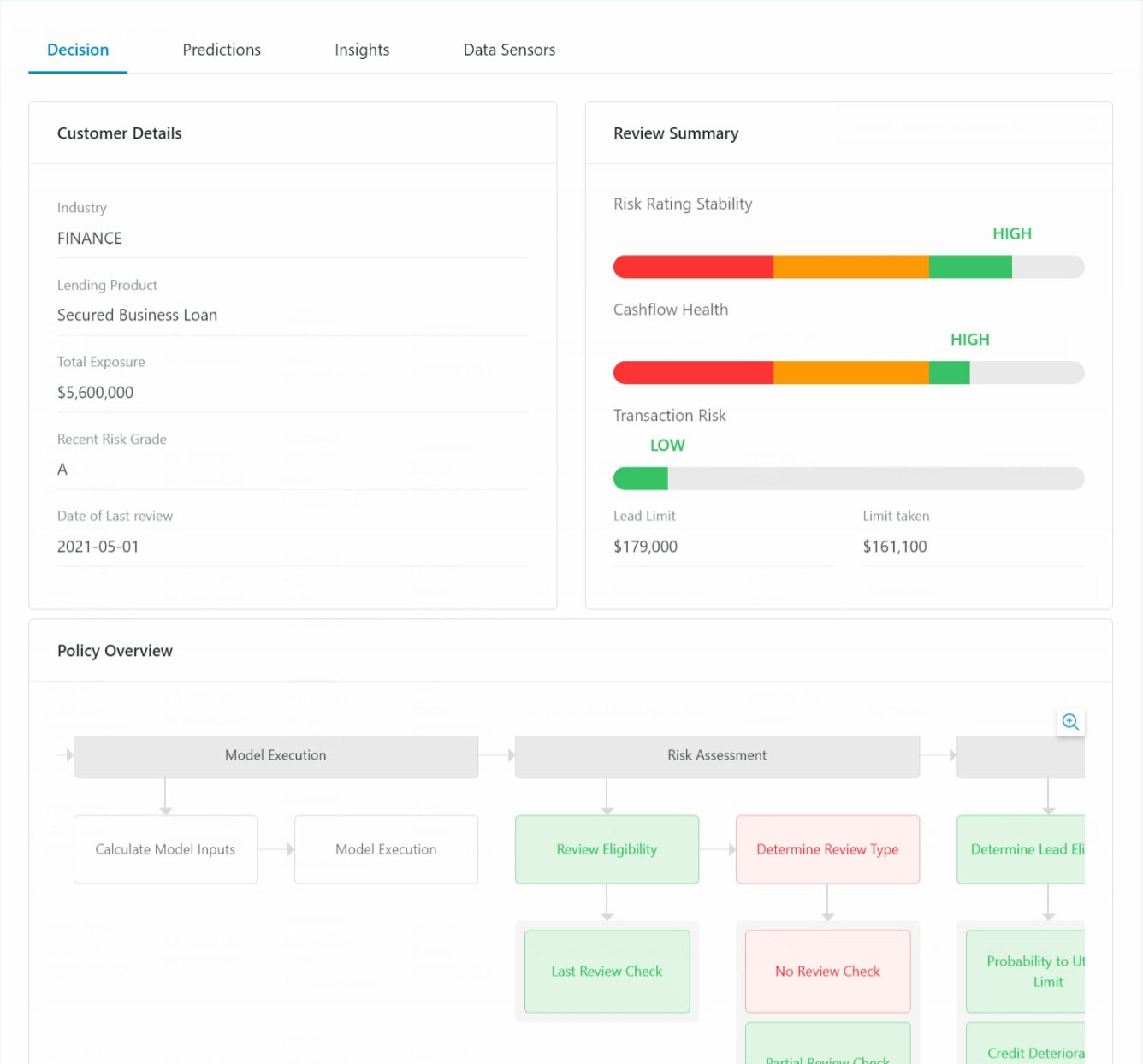

Self Describing Decisions

AI-enriched Decisioning

We understand your need to safely leverage AI. We have a unique method to provide confidence and transparency in meeting your objectives for safety, we call this the Self Describing Decision.

Contained in a single data object, every element is explained. All model features and predictions, all reference data, and all rules triggered. A Self-Describing Decision is a complete record of all the information used to generate a decision outcome. Governance and explainability, baked in. Every time.

Our templated use cases embed IP to enable rapid implementation. We leverage our experience in deploying integrated predictions and decisions with our engagement methodology to deliver at the “speed of business”.

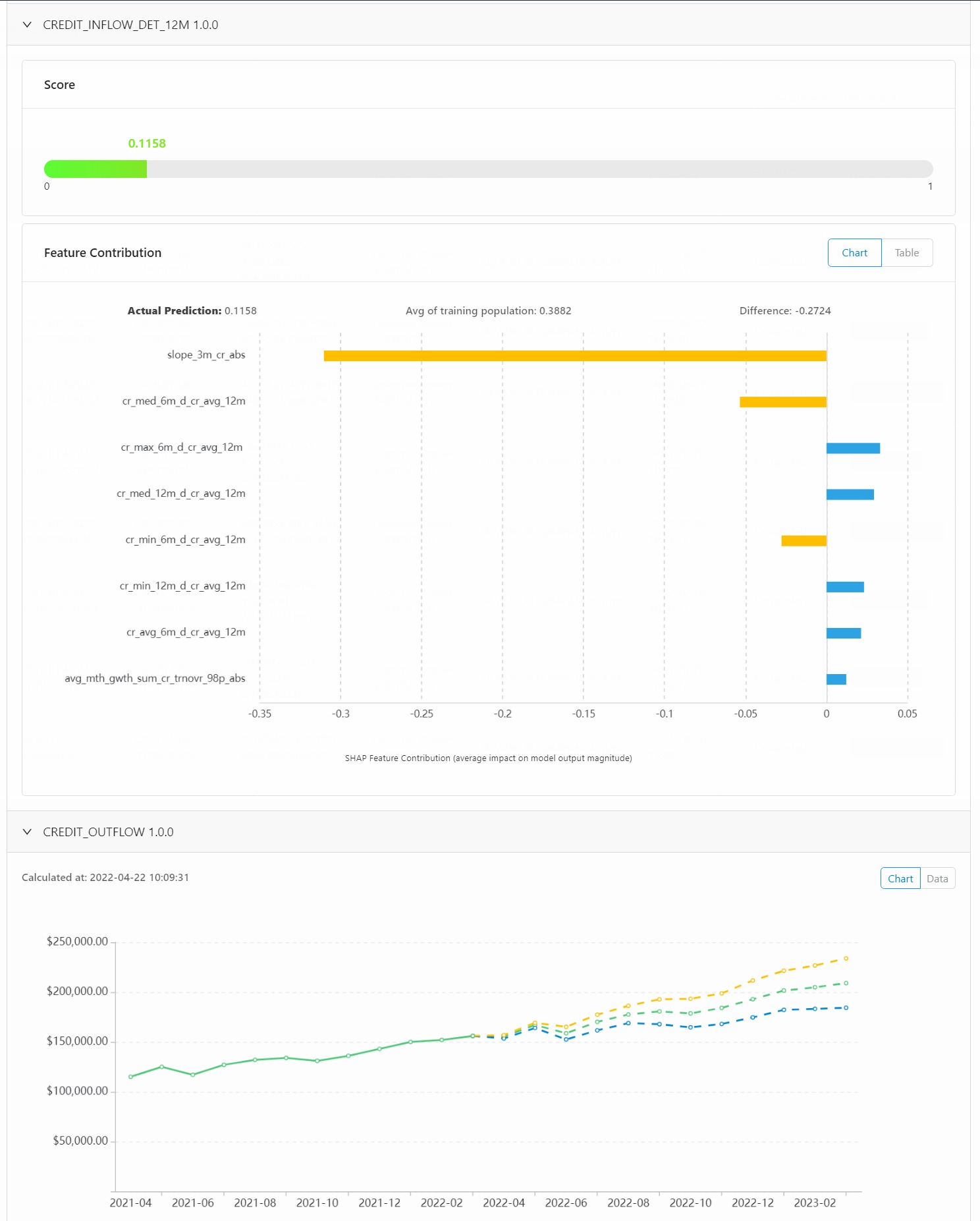

Predictions

Integrated AI resulting in superior predictions.

Our platform enables you to:

- Design, Run, and Manage Predictive Models in a single environment

- Understand feature performance

- Manage model performance and governance

- Accumulate decision logic, enabling AI to learn from experience

- Streamline reporting within an integrated single environment.

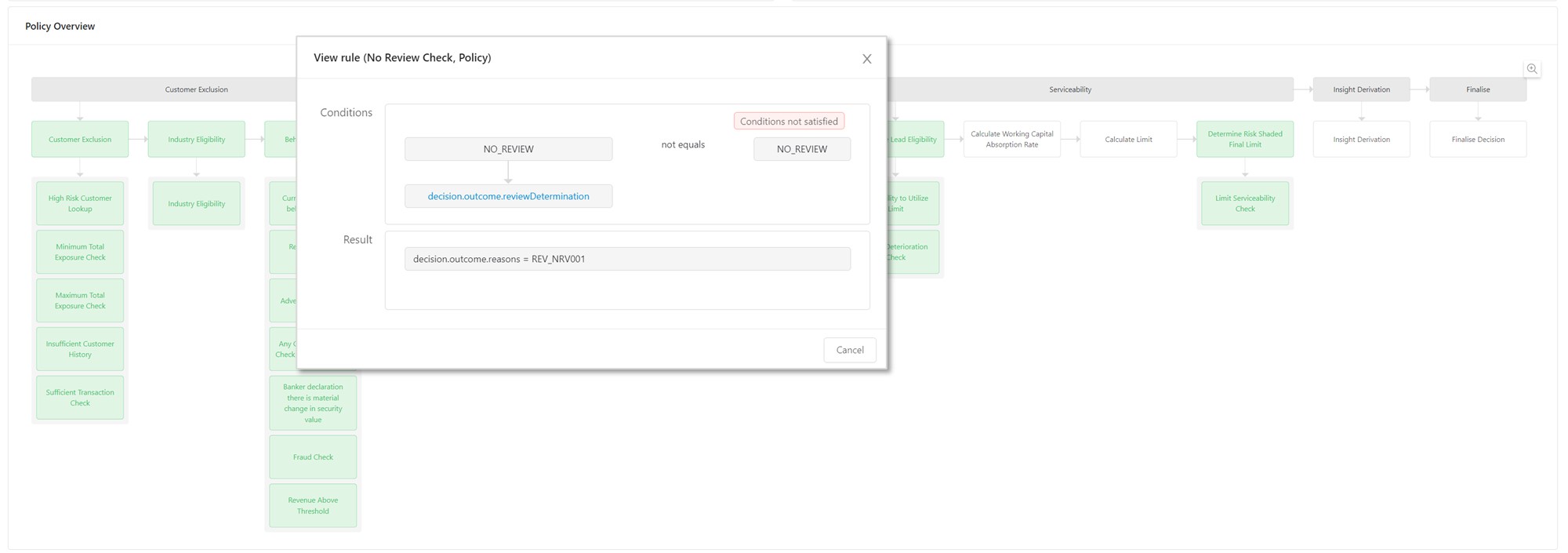

Decisioning

Optimal decision outcomes

Using RDC you can:

- Design, Run, and Manage your Decision Strategies

- Interpret Self-Describing Decisions with visualisation tooling

- Understand and optimise rule performance

- Seamlessly publish changes to your decision strategy

- Implement ‘stateful’ decision flows, standardising one-to-one relationships between applications and decision outcomes.

Safe and secure

The RDC platform is designed, with security and compliance in mind. Ensuring customers can meet compliance requirements is integral to our operations.

Our cloud-native design is agile and flexible, ensuring we can deliver to your needs. We work closely with all major cloud services providers, and provide SaaS and VPC deployment options.

We take security and data privacy seriously. Our operations are ISO27001 certified.

We’re committed to delivering high-quality services to our customers and ensuring the confidentiality of their data. Our operations are SOC 1 Type 2 accredited.

The RDC platform

Our AI decision design provides deep financial services through domain expertise to drive the use of new AI techniques in business lending decisioning. Decision execution and monitoring create an immutable explainable decision record with end-to-end performance monitoring.

Design

Maximise understanding of data to effectively derive features, build models, and map out decision flows.

Run

Implement decision strategies, and operationalize models in real-time.

Manage

Govern model performance, and understand performance of decision strategies

AI-native Intelligence

A set of distinct principles guides our AI-led approach

Real Time

Distributed

Accumulative

Teachable

Explainable

NAB turns to AI to decide on small business loans.

“We partnered with Rich Data Co for their proven ability to innovate, augment and expand our small business lending capability. Their platform enables us to innovate and accelerate our lending options in this market, leveraging alternative data and AI techniques.“

Howard Silby

Chief Innovation Officer, NAB

Experience the RDC difference

Book a demonstration to see the power first-hand