Delivering the Future of Credit, Today

By Ada Guan, March 2019

The process of assessing consumer and small business credit risk, and making lending decisions is going through a generational change.

This change has been driven by:

- Unmet credit needs: It is estimated that currently 3 billion people around the world have no access to basic credit services, while approximately 70 percent of small business in emerging markets lack access to the credit they need.

- Data explosion: The amount of behavioural data generated and captured is truly mind-boggling. Every day, 5 quintillion bytes of data is created, and this growth is continuing to accelerate with thanks to the Internet of Things (IoT). In fact, 90 percent of all of the data in the world was generated in the last two years alone. (Forbes, 2018)

- Advancement of Artificial Intelligence in its ability to understand human behaviour

From the past to the present

Historically, many banks have used Predefined Scoring formulas (e.g. Altman Z-score) or simple statistical models (e.g. Logistic Regression) to assess consumer and small business credit risk.

This method works well where the number of variables/features is static and infrequently updated. Experts in credit risk often manually segment the data and build a model for each segment. This approach clearly explains the derivation logic of a score which is often demanded by the banks and regulators. Human experts can typically process between 5 and 25 variables, and between 1,000 and 1,000,000 rows records. The process to develop the models can take weeks to months.

With the aforementioned data explosion and fast pace of consumer behaviour change, this approach is clearly insufficient to satisfy the demand for the future of credit. As such, many Artificial Intelligence engines came into play to fill in the capabilities and demand gap.

So, the key questions are:

- Can the AI-based Credit Scoring and Decisioning Engine replace the traditional statistical engine?

- What are the key business challenges and opportunities for the engines?

Specifically, we want to know if the engines can:

- Process up to 1 million variables and 1 trillion rows?

- Score in real time based on a real time data feed from multiple channels?

- Have superior model accuracy, with more consistent model performance?

- Provide a better explanation of the modelling?

- Self-learn in near real time?

- Adopt and adapt learning from previous experience (projects/domains), become intelligent enough to understand their limitations, and therefore know when we need to ask for advice from human credit risk experts?

Ten years ago, this would have seemed to be in the realm of science fiction. However, as technological advances steadily enable seamless fusions of human expertise and artificial intelligence, this is increasingly becoming science – without the fiction.

How RDC is delivering the future of credit

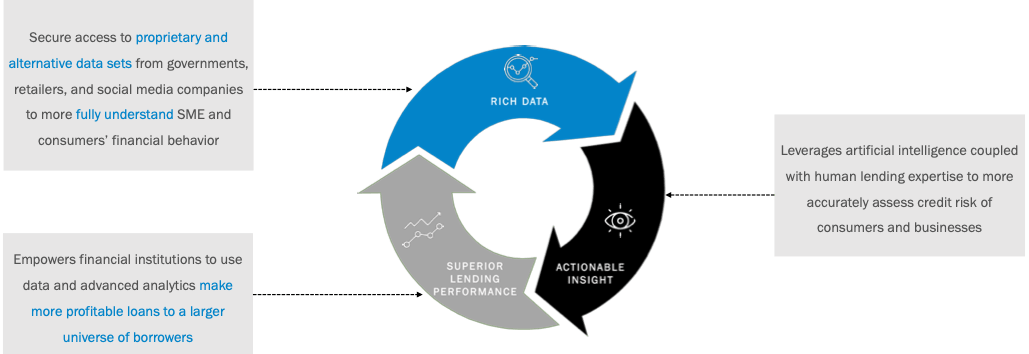

RDC is at the frontier of AI credit scoring and decisioning; leveraging rich data and actionable insight, which has resulted in superior lending outcomes for our financial services clients, most notably:

- Raising the loan portfolio of a Canadian lender by 10% with no increase in bad debt

- Reducing the cost of lead acquisition for an Australian bank from $90 to $7 per application

- Deriving insights from the analysis of 90,000 SME tax records to identify ways to reduce the SME lending default rate for Chinese banks, by predicting the likelihood of SME business failure. RDC managed to reduce default rates for these clients from 14% to 9%

Superior outcomes require superior data

RDC secures access to proprietary and alternative data sets from governments, retailers, Telcos and social media channels. We focus on behaviour data from these diverse data sources, that are fast moving, dynamic in structure and often incomplete, e.g. POS data, utility data and social media data.

RDC processes this behaviour data to create features that then predict lending outcomes, leveraging automatic/interactive feature construction, Natural Language Processing (NLP), psychometric and behaviour economic analysis.

Achieving actionable insight

RDC is building its state of the art Artificial Intelligence core engine (Intelligent Cloud) to power all RDC financial products, which closely mimics the human brain with the following attributes:

Real-Time Intelligence: The RDC Credit Scoring Engine continuously learns from new data, interacts with human experts to continuously capture new features, and combines multiple models – to create a more accurate and more stable model performance. This enables RDC to use real time / near real time transaction data to credit score. For example, using POS data for to credit score, and make credit decision in real time.

Explainable Intelligence (xAI): An explanation of the derivation of each score, that can be visualised in an interactive interface. This feature helps to gain human confidence and trust, while also enabling human experts to validate the derivation of the scores. One of the key challenges for financial services organisations when leveraging AI credit scoring engines is that many engines are “black boxes”. Although the modelling might generate accurate predication, it is difficult for bankers and credit experts to understand why and how this outcome has been generated. With explainable intelligence, we are putting the understanding and control backs in bankers’ hands.

Artificial Intelligence + Human Intelligence: This involves the seamless seamless integration of automatic learning from data (via machine learning) and interactive learning from experts (knowledge capture). This complementary integration enables AI to learn from both human intelligence/expertise and raw data, and enables AI models to understand when they need to learn more or interact with human experts for advice. It also delivers AI insights, assisting human experts to complement their knowledge and highlight outcomes, that together, can feed thinking about new enhancement opportunities.

In our experience the AI and human intelligence combination generates the most accurate credit scoring, and it also allows lenders to enter lending domains where no data or limited data is available for modelling.

Accumulative Intelligence: Using transfer learning facilitates the progressive build of smarter AI models, as knowledge is incrementally accumulated from previous and concurrent domain related projects. Transfer learning, in essence, is Artificial Intelligence having the ability to break down a large concept into smaller elements and understand them well enough to recognise similarities between what it has learnt and what it has yet to learn. Applying transfer learning in credit scoring and consumer / small business profiling, means RDC AI engine is building up a library of features in order to understand consumer behaviour.

There is no doubt that the global state and future demand for consumer and SME credit will continue to change – but the learning capabilities of RDC’s Intelligent Cloud will evolve with these changes in the constant pursuit of generating the most accurate credit scoring, and enabling lending where it was not previously capable.