The future of credit. Today.

AI Powering Sustainable Lending

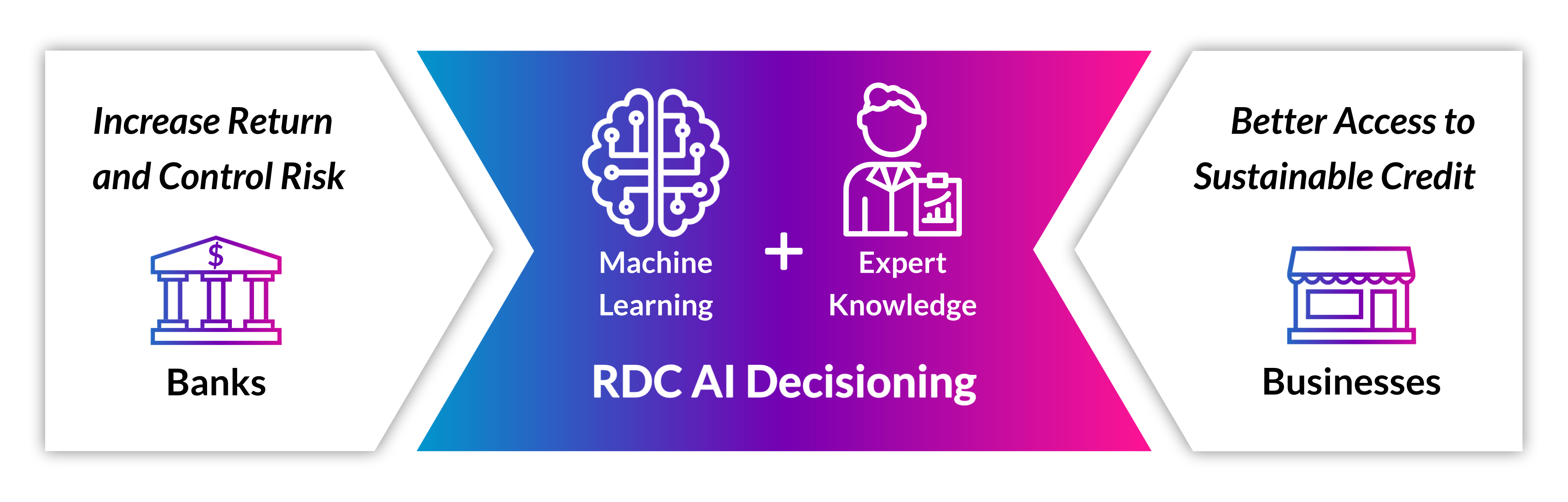

Welcome to RDC, where our cutting-edge AI technologies and solutions transform the landscape of business and commercial lending. By harnessing the power of machine learning and blending it with human expertise, we offer unparalleled insights that bring transparency, compliance, and accountability to every decision, driving growth and fostering opportunities in your financial portfolio.

The future of credit

The credit industry is undergoing significant transformation due to a surge in data, evolving borrower behaviours, heightened regulatory oversight, and advancements in cloud computing and AI.

To stay competitive and meet evolving customer demands, lenders must innovate swiftly. Our unique AI capability empowers business and commercial lenders to embrace disruption and remain at the forefront of this dynamic era of change.

Credit where it’s due

At the heart of our mission lies a commitment to inclusive, fair, sustainable, and dynamic credit solutions for every business borrower.

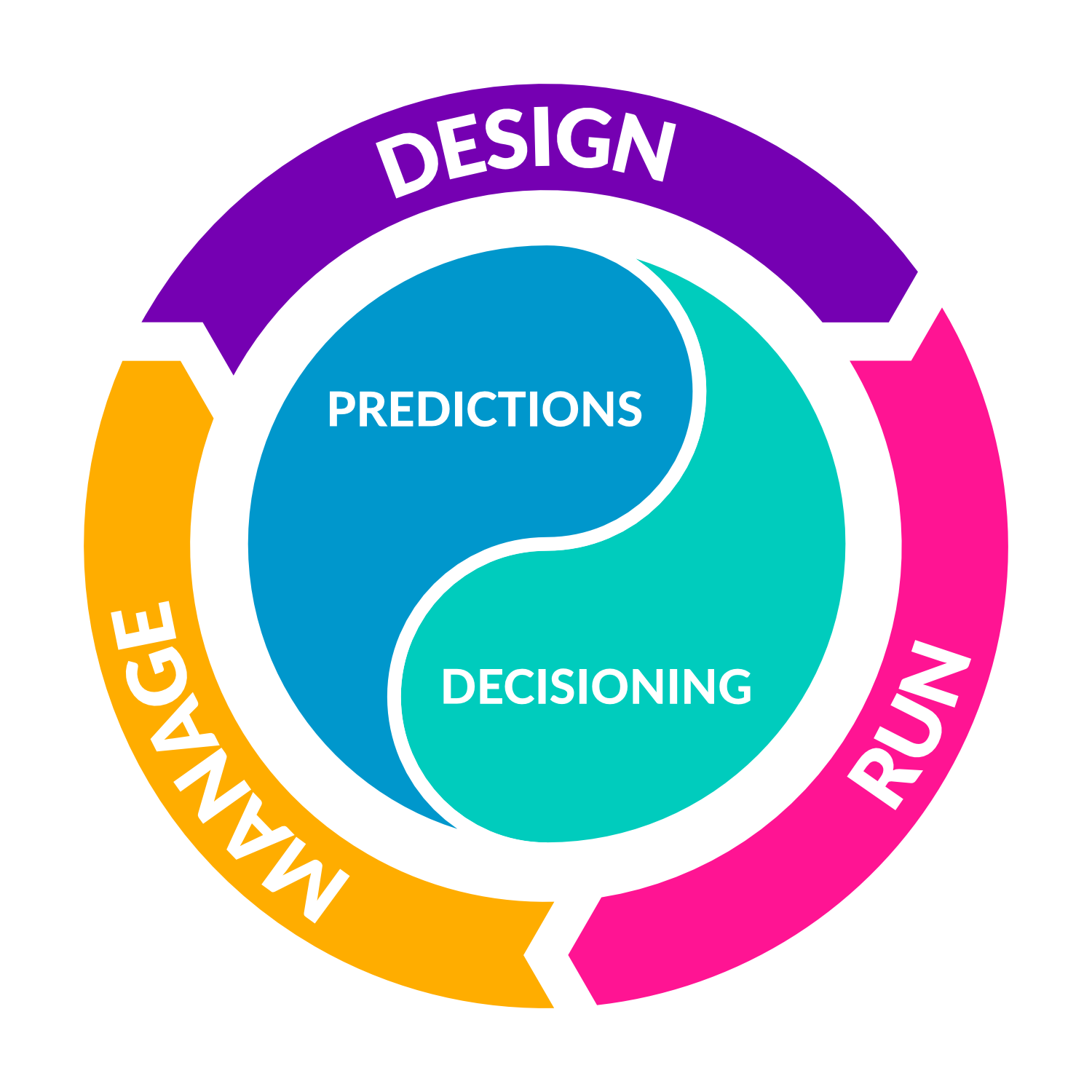

Harnessing alternative data sources, our AI Decisioning platform provides insights into borrower behaviour far beyond traditional credit sources. We bring together AI-driven predictions and projections with an easy to maintain and manage decision strategies that span all phases of the customer lifecycle.

Key Benefits

Comprehensive Insights

Utilises alternative data to provide a deep understanding of borrower behaviour beyond traditional credit sources

AI-Driven

Predictions

Employs advanced AI algorithms for accurate predictions and projections, enhancing decision-making

Integrated Decision Strategy

Manages the decision-making process seamlessly throughout its lifecycle, ensuring efficiency and consistency

Inclusive, fair & sustainable

Promotes inclusivity by offering dynamic credit solutions for business borrowers while supporting responsible lending practices

Regulatory Compliance & Customisability

A tailored solution aligned to regulatory standards and adoption of lenders’ policies, to meets compliance requirements

AI Decisioning

The power of AI + Human Intelligence at your fingertips

Enhanced Predictive Insights & Decision-Making

RDC’s platform utilises AI and alternative data to gain deeper insights into customer behaviour. Employing templates and an integrated delivery methodology, we swiftly tailor solutions to meet your unique requirements. Our software and proprietary technology collaborate to enhance both borrower and lender experiences at the point of origination and throughout the credit lifecycle.

- 5Drive Profitable Growth: Increase approval rates for a more profitable portfolio

- 5Minimise Credit Losses: Enhance credit risk assessment to reduce losses

- 5Ensure Regulatory Compliance: Utilise explainable models for compliant decisions

- 5Boost Efficiency: Automate origination and review processes for streamlined operations and proactive targeted engagement

- 5Elevate Customer Experience: Enhance insights by leveraging cashflow data for improved customer and banker experiences

Trusted by clients to deliver innovation

nCino Expands nIQ Offerings through Partnership with Rich Data Co

RDC has a proven ability to innovate, augment and expand small business and commercial lending. We are confident this partnership will drive significant business value for our customers and enable us to drive further adoption of AI and machine learning in the broader financial services industry.

Chris Gufford

General Manager of Commercial Product for nCino

Helping you achieve your goals

We collaborate with every stakeholder involved in the lending process, setting benchmarks for project success and realising tangible business outcomes.

Credit Risk Management

Ensure decision strategies and predictive models are tailored to align with your organisation’s risk appetite and withstand regulatory scrutiny.

Head of Commercial / Business Lending

Identify changing market conditions early and prioritise business objectives for optimal outcomes.

Modelling Expert

Harness machine learning algorithms renowned for their high accuracy, with built-in explainability and robust model performance monitoring features.

Origination Excellence

RDC’s platform seamlessly integrates robust AI predictions and decision-making capabilities, ensuring lenders can safely and accurately facilitate credit origination.

Portfolio Monitoring

Optimise the management of your lending portfolio with RDC. Effectively manage risk, pinpoint growth opportunities, and streamline automated customer and facility reviews.

Our longstanding academic partnerships ensure continued leadership in both insight and innovation

Experience the RDC difference

Book a demonstration to see the power first-hand